In the fast-paced world of property management, ensuring the safety and security of your tenants' belongings is paramount.

Renters insurance provides a safety net that protects tenants and gives property managers peace of mind.

In this comprehensive guide, we'll delve into the top 5 best renters insurance companies.

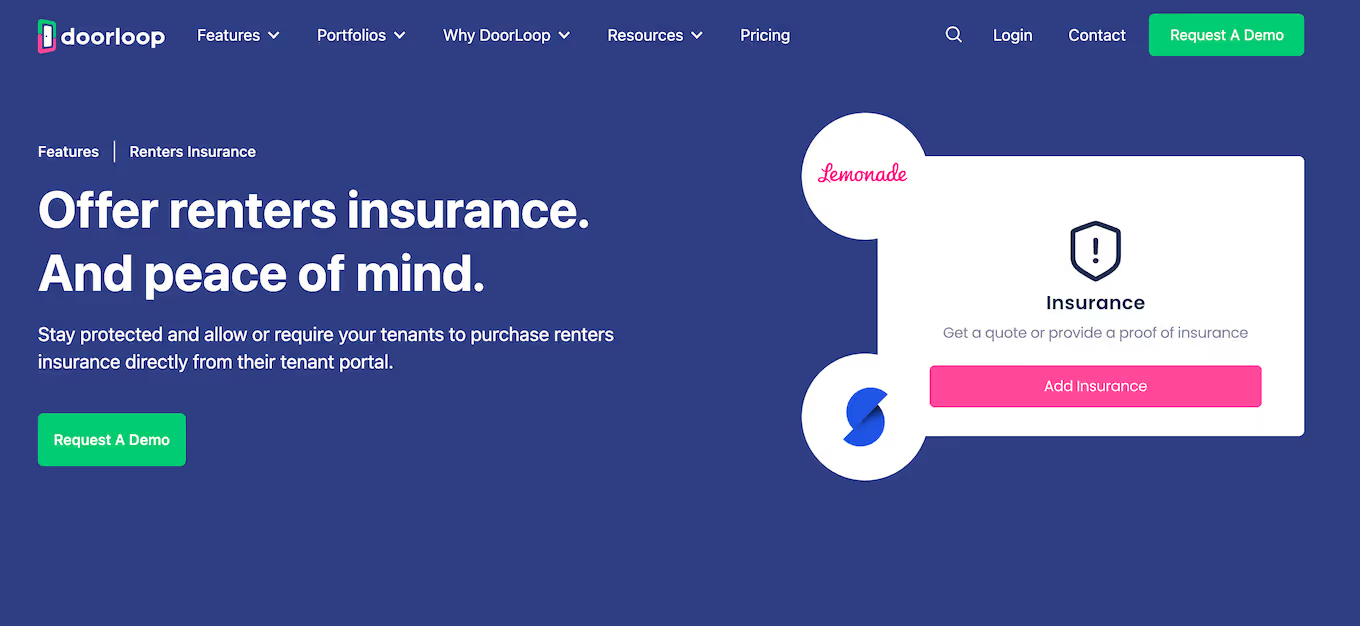

We'll also explore how property management software, particularly through platforms like DoorLoop, can streamline the process of renters insurance acquisition and verification.

Is Renters Insurance a Necessity?

You may be able to require renters insurance, but is it truly a necessity? Why would you want to require renters insurance for your tenants?

Renters insurance isn’t a true necessity, but, much like car insurance, not having it is a big risk not only for your tenants but also for you.

What Does Renters Insurance Cover?

Renters insurance typically covers the following:

1. Liability due to injury

In the case of an injury by a guest visiting the property, your tenant would be liable. Renters insurance typically covers any form of injury incurred by a guest while on the property.

2. Damage from natural disaster to tenant’s belongings

This includes any tenant belongings such as electronic devices, furniture, kitchen appliances, jewelry, vehicles, and more in the event that they’re either damaged or destroyed.

3. Theft

Similarly, if a tenant’s belongings are stolen, or the property is damaged, as a result of theft, renters insurance typically covers the damages.

Top 5 Renters Insurance Providers

1. Lemonade

When it comes to navigating the landscape of renters insurance, Lemonade emerges as a true game-changer.

As a property manager, you understand the importance of efficiency and convenience in every aspect of your responsibilities. That's where Lemonade's innovative approach to insurance comes into play, embracing the digital age to provide a seamless experience for both you and your tenants.

What is covered?

Here is Lemonade's renters insurance coverage:

- Theft of personal belongings

- Fire

- Vandalism

- Windstorms

- Certain water damage

- ... and injuries sustained by visitors at your place.

What makes Lemonade stand out?

Lemonade's standout feature is its commitment to digitalization.

The traditional paperwork-heavy insurance process can be time-consuming and cumbersome. Lemonade understands your need for streamlined operations.

With their digital platform, you're able to bid farewell to lengthy forms and endless waiting times. Instead, you and your tenants can navigate through the insurance journey from the comfort of your devices.

2. Sure

Sure, backed by Assurant, stands out as a renters insurance provider that truly understands your needs.

As you navigate the intricacies of property management, the integration between Sure and your property management software offers a revolutionary way to simplify the insurance process for both you and your tenants.

What is covered?

Here is what is covered under Sure's rental insurance:

- Personal Property: Protection for your belongings, even if they're damaged anywhere globally.

- Loss of Use: If your property becomes uninhabitable, expenses related to housing and increased living costs will be included.

- Personal Liability Protection: Covers bodily injury or property damage for which you're legally liable, with no deductible.

- Replacement Cost: If personal property is damaged due to covered perils, they will replace items.

- Sewage or Drain Backup: Protection for personal property damaged by water backup from sewers or drains.

- Identity Fraud Expense: Helps cover expenses and time needed to restore identity after fraud.

What makes Sure stand out?

Having tenants purchase coverage or upload insurance documents via the tenant portal has never been easier, thanks to Sure's integration capabilities.

This tenant-centric approach empowers your renters to take charge of their insurance needs directly within the platform they're already familiar with.

The traditional back-and-forth of paperwork and communication is replaced by a streamlined digital interaction that benefits both you and your tenants.

3. Resident Shield

In the field of renters insurance, Resident Shield stands out by prioritizing personalization. As a property manager, you understand the individuality of each tenant's needs.

Resident Shield's customized insurance offerings not only acknowledge this reality but also offer a variety of coverage choices that align with the distinct demands of your tenants.

What is covered?

Here is what is covered under Resident Shield rental insurance:

- Property protection

- Personal liability protection

- Guest medical payments

- Additional living expenses

What makes Resident Shield stand out?

The insurance solutions they provide are tailored to match the unique circumstances and belongings of every tenant.

This ensures that tenants, regardless of whether they're students, professionals, or families, can feel confident that their coverage is specifically adapted to their needs.

They even offer specific discounts for senior communities.

4. MSI

Millennial Specialty Insurance (MSI) is dedicated to serving niche markets with efficient and tailored insurance solutions. They specialize in insurance distribution for property managers requiring proof of insurance as part of Lease Agreements.

What is covered?

Their website is not fully informative on coverage, but in some MSI-backed Renters Insurance, it offers liability coverage worth $100,000.

Residents also have the option to select personal property coverage at levels of $10,000, $15,000, or $30,000.

These policies also safeguard residents against guest medical expenses and emergency living costs.

What makes MSI stand out?

MSI's cloud-based platform is a reliable, user-friendly, and mobile-responsive.

They also provide partners with a range of choices for seamlessly integrating their services into existing technology, facilitating the convenient provision of their products to customers.

5. State Farm

"Like a good neighbor..." you know the deal.

State Farm offers a pretty comprehensive coverage list and the best part is that it is a well-known name- so you might already be familiar with their processes (like auto insurance... etc).

What is covered?

Here is what is covered under Resident Shield renters insurance:

- Personal Property Coverage: This protects your belongings against damage or loss due to covered events like fire, theft, vandalism, or certain natural disasters.

- Liability Coverage: If someone gets injured in your rented property and you're found legally responsible, liability coverage helps pay for medical expenses, legal fees, and potential settlements.

- Medical Payments to Others: If a guest is injured in your rental unit, this coverage helps pay for their medical expenses, regardless of who was at fault.

- Additional Living Expenses (ALE) or Loss of Use: If your rented property becomes uninhabitable due to a covered event, ALE covers extra living expenses like hotel bills, meals, and other costs.

- Property Damage to Others: If you accidentally damage someone else's property, this coverage can help you pay for the repairs or replacements.

What makes State Farm stand out?

State Farm's renters insurance stands out from other providers due to its comprehensive coverage options and the company's longstanding reputation for reliability. With a wide array of coverage choices, State Farm enables renters to customize their policies to match their specific circumstances.

So, Who Wins?

In terms of renters insurance, we know that you have a wide array of options with different characteristics.

Our favorite choices on this list are Lemonade and Sure, which is why DoorLoop offers the choice of adding their renters insurance policy to your tenant's account!

All your tenant has to do is open the "insurance" tab on their tenant portal... et voilà... you and your tenant are protected.

.avif)

.svg)

.svg)