As budgeting season approaches, property managers are preparing to review and plan their finances for the next year. This yearly task is important for both small owners and those with bigger property portfolios.

A good budget helps property managers handle their finances better in the upcoming year. Whether you’re searching for ways to enhance your business management or are already with DoorLoop, we’ll share tips to navigate this period more effectively.

In this guide, we'll cover key budgeting strategies for property managers and show how DoorLoop's advanced budgeting feature gives you a competitive edge.

Why Budgeting Season Matters for Property Managers

You already know how important budgeting season is—it’s the time to refine financial plans and set the course for the year ahead. A budget helps things run smoothly, tackles problems before they happen, and creates room to grow.

By reviewing your income, expenses, and investments now, you'll be prepared to meet your goals and take advantage of opportunities as they come. Let’s break down how you can make the most of this time.

Build Financial Resilience

A key aspect of budgeting is setting aside money to cover surprise expenses without hurting your property’s profits. You must be ready for unexpected costs like repairs, market changes, or sudden expenses.

Using historical data to predict trends and considering both fixed and changing costs, helps you create a budget that helps your property grow while staying flexible for the future.

Keep the Basics in Check

Look at historical data to understand your cash flow and plan your future expenses. Keeping an eye on both fixed and variable costs helps cut down on unnecessary spending, protecting your properties and business.

Using technology to simplify budgeting is important, especially if you're managing many properties. A strong software like DoorLoop tracks utility bills, maintenance, vacancies, and rent collection, helping you find ways to save money and grow.

Strong financial management shows that you’re serious about keeping your properties running efficiently and profitably.

Top 5 Budgeting Tips for Property Managers

In this section, we’ll discuss some budgeting tips that can help you stay ahead of your financial goals and keep your properties running smoothly.

1. Review Past Performance

One of the most important steps in budgeting is to look back at last year’s actual expenses compared to what you originally budgeted. This will help you see where you went over or stayed under budget and then you can make adjustments for the upcoming year.

2. Account for Future Maintenance and Repairs

Property maintenance is accounted for, but emergencies can and will happen. That’s why it’s important to set aside a part of your budget specifically for repairs and emergencies. Having a fund ready will help you stay prepared and avoid unexpected financial stress.

3. Prioritize Operational Costs

Your property’s operating costs, like insurance, utilities, and property taxes, can change from year to year, plan for any increases.

4. Factor in Vacancy Rates

Even with the best property management, vacancies happen. Plan for the possibility of vacant units, which can lead to a temporary loss of income. Make sure you’re not caught off guard as these expenses tend to be high.

5. Use Technology to Your Advantage

Managing your budget doesn’t have to be a headache, thanks to modern property management software like DoorLoop. With tools that automate financial processes and give you real-time insights, you can make smarter decisions faster. Using technology like this can help you save time and avoid human error, giving you a clearer picture of your property’s financial health.

Planning Ahead with DoorLoop’s Budgeting Suite

Whether you’ve been using DoorLoop for a while or are thinking about switching to a smarter property management tool, our budgeting feature is just what you need this financial season.

Here’s a behind-the-scenes look at how you create a budget using DoorLoop.

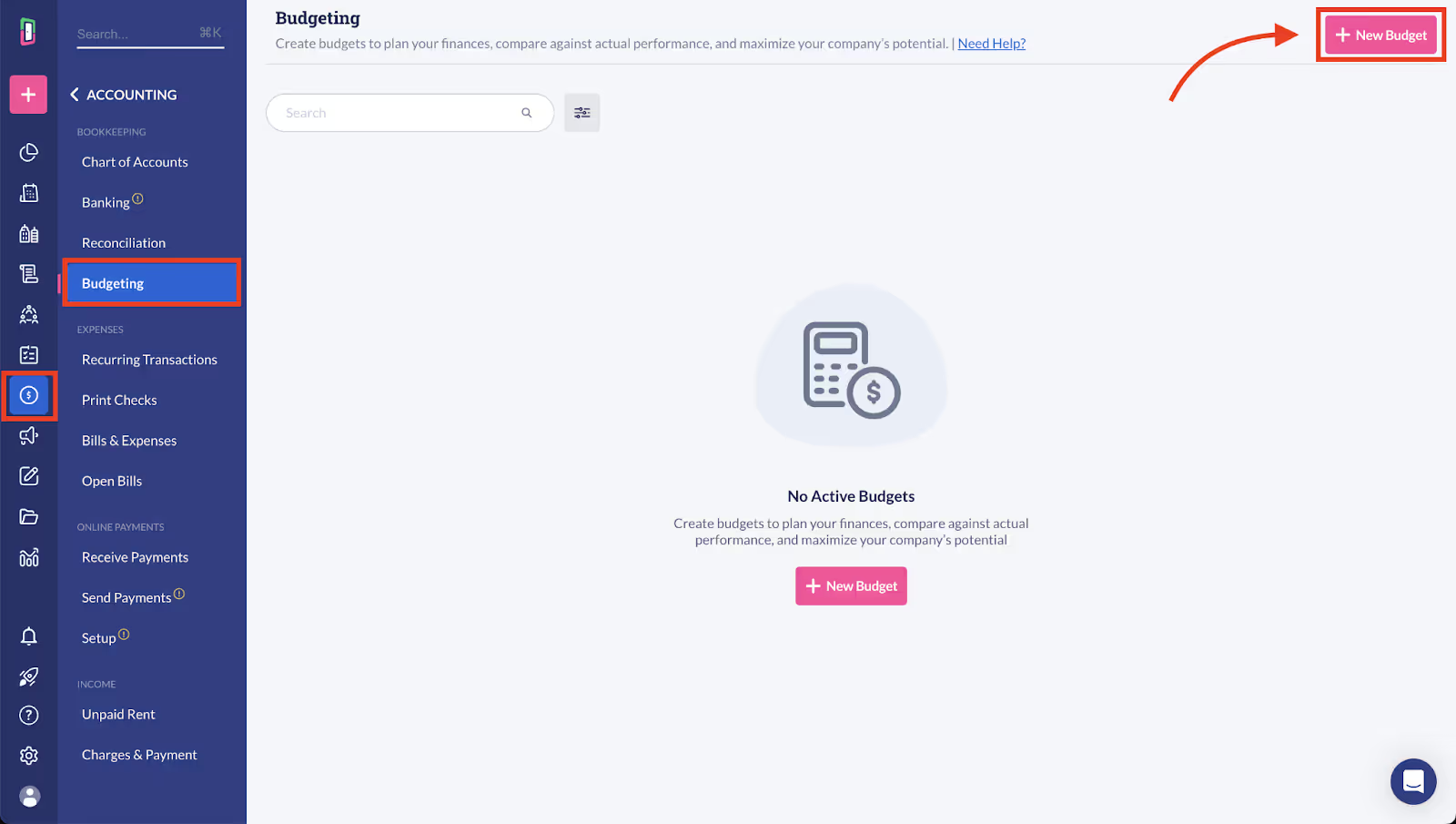

Located within the Accounting tab, this tool enables managers to streamline financial planning, monitor expenses, and forecast revenues for both individual properties and entire portfolios.

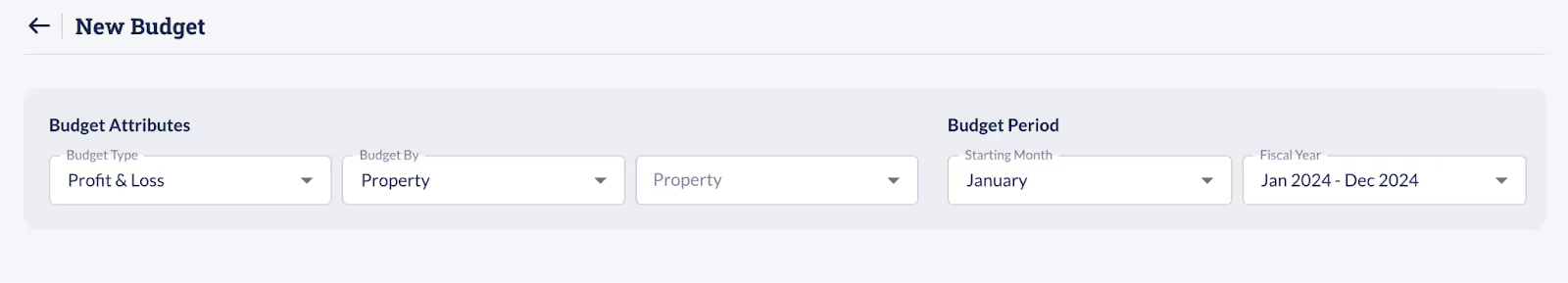

On the Budgeting page, you'll set a few parameters to begin.

First, select your budget attribute, either Profit & Loss or Balance Sheet. Then, decide if you're creating the budget for a specific property or portfolio. The next field will adjust based on your choice. Afterward, choose the starting month for your budget, typically the first month of your company's fiscal year. Finally, select the fiscal year for which the budget will be created.

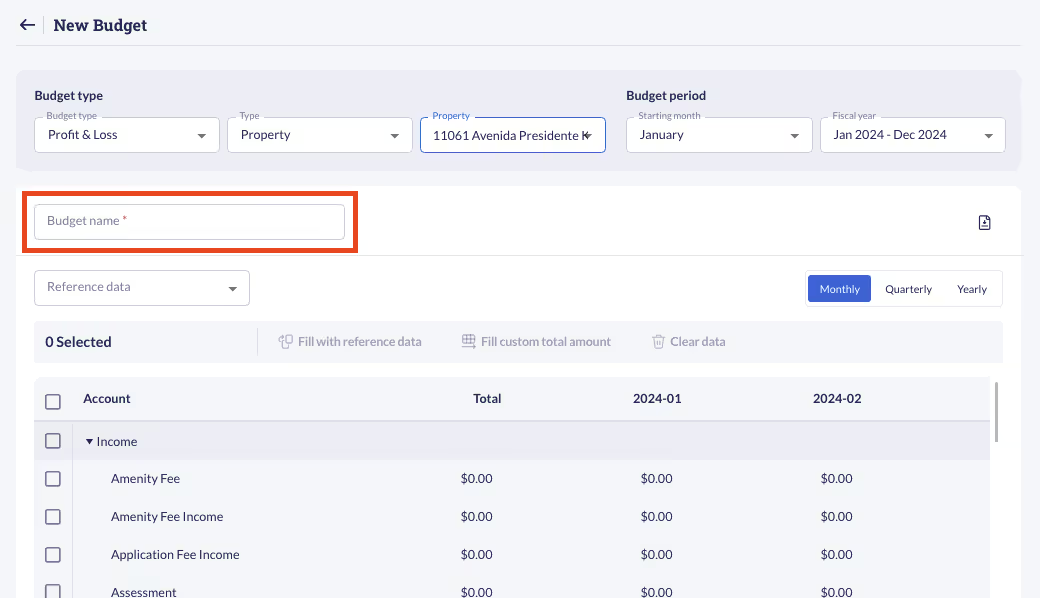

After entering the parameters, the budget table will appear below, allowing you to start inputting your data.

Begin by giving your new budget report a name. Now, choose between Monthly, Quarterly, or Yearly to set the breakdown for your budget period. To start entering data, simply click on any input field.

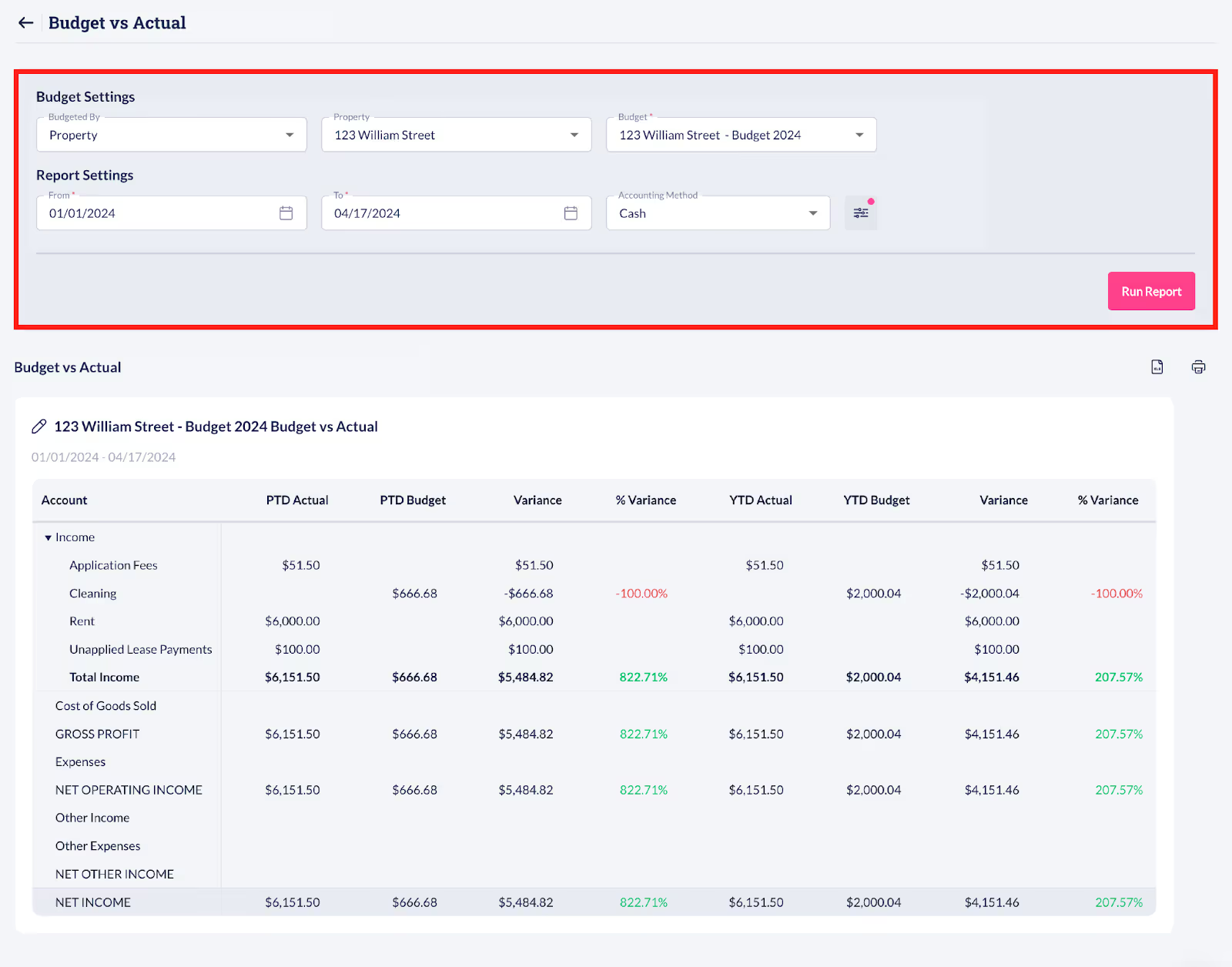

Here’s an example of what a budgeting report looks like in DoorLoop:

Here’s how DoorLoop elevates the way you do budgeting and finances:

- Comprehensive Financial Planning: DoorLoop allows you to create detailed budgets for individual properties or entire portfolios.

- Expense Management & Tracking: Stay on top of your expenses with an easy-to-use tracking system. Allocate funds efficiently to avoid overspending.

- Revenue Projections: Get accurate forecasts for rental income and other revenue streams, making future planning easier than ever.

- Cash Flow Management: DoorLoop helps you ensure that your cash flow remains steady, even during the most challenging periods.

This feature is available for Pro and Premium Plan users, so if you haven't upgraded yet, now’s the perfect time!

For those considering DoorLoop, choosing these plans gives you access to powerful budgeting tools that streamline financial planning and helps you manage your properties more effectively.

Bottom Line

Budgeting season is the ideal time to reassess your financial strategy and set yourself up for success. DoorLoop's advanced budgeting features streamline the process, making it effortless to manage expenses, project revenue, and maintain a steady cash flow. For existing DoorLoop users, now is the time to fully utilize these features.

If you're not using DoorLoop yet, upgrading to our Pro or Premium Plan unlocks these powerful tools, giving you a competitive edge this budgeting season.

Ready to elevate your property management finances? Sign up for a free demo and discover how DoorLoop helps you manage your property finances effortlessly.

.svg)

.svg)