As a property owner, you always wonder if you should allow tenants to pay by credit card, ACH, checks, cash, Venmo, Zelle, CashApp, PayPal, or any other method.

While there are many payment options for tenants to select from, it appears they are now becoming more inclined to use their credit cards to pay rent so they can earn points, even if it costs them an extra 3%.

In this article, you will learn everything you need to know about offering tenants the options to pay rent online. You will also learn about the advantages and disadvantages of using these payment methods, and other payment options your tenants may want to use.

Advantages of accepting rent with a credit card

Here are a few reasons why tenants prefer to use credit cards to pay their rent and why landlords and property managers should offer it as an option.

Advantage #1: Tenants Improve Their Credit Score

You will find it rather amusing that some tenants actually want to pay rent with credit cards, even if it costs them extra.

Why? When tenants have a low credit score, they will not be able to get good rates on anything from a new car lease, new car purchase, new house purchase (mortgage), and more.

However, when they start paying rent on time each month with credit cards, their credit score generally will go up.

The reason is that tenants prove their creditworthiness when paying with credit cards because it gives the impression that they are already clearing the debt they owe.

Advantage #2: Cover Lack of Funds

Aside from paying rent with a credit card to build credit, tenants also do so because they don’t always have enough cash in the bank.

They could be salary earners, and when their salary is paid, they may have either been neck-deep in debts or many days away from when they ought to pay their rent. When living paycheck to paycheck, they are forced to pay with credit cards.

Advantage #3: Earning Points

Some tenants may wish to pay rent with a credit card if they have a certain amount they need to spend in order to earn a bonus.

There are plenty of credit cards that offer large signup bonuses anywhere from 50,000 to 100,000 points. In order to receive that bonus, they need to spend a certain amount of money in a certain time period. For example, spend $3,000 in 3 months and earn 50,000 points.

The 50,000 points are usually worth $500 or more in benefits (travel, flights, hotels, car rental, etc...) so it’s worth it for them to pay with a credit card.

Disadvantages of accepting rent with a credit card

Although credit cards make it easier for everyone to pay rent, and for the landlord to collect rent automatically, there may be some reasons a landlord may prefer cash, a check, or ACH instead.

#1: May take longer to receive the money

Depending on the rental terms, most tenants normally pay rent on the same day of each month (like the 1st of the month).

Depending on the credit card merchant processor you use, it make take a few days to receive the payment in your bank account. Check with your merchant processor beforehand to find out when the money will enter your account, and see if there is a way to expedite it if needed.

It still may be worth it to offer credit cards as a payment option to ensure that your tenants can pay rent on time if they don’t have money in their bank account.

#2: May lower the tenant’s credit score

If the tenant already has a great credit score (above 700), and doesn’t need to raise it anymore, adding a rent payment may decrease their credit score.

This is because a large part of a credit report is the Utilization Ratio of the amount of credit the tenant has, and how much they use their available credit.

Companies like to see that you have a lot of credit you can use, but you don’t actually use it. So if you have $10,000 available on all your credit cards, but only use $2,000/month, then your utilization rate is only 20%.

PRO TIP: If you need to quickly increase your credit score, simply pay off all your credit cards multiple times a month so you never have a balance.

Checks & ACH

Checks and ACH are other rent payment options you may want to consider. Below, we have explained some of the benefits and downsides of each of the two, so you will be in a better position to decide which is the best.

Advantages of Accepting Rent via Checks

- Checks can be postdated for cashing out on the due date.

- Can not be disputed later on (although they can bounce).

Disadvantages of Accepting Checks for Rent Payment

- Receiving a check doesn’t necessarily mean that your tenant has the specified amount in the bank account to pay the rent so the check can bounce.

- You will be charged a bank fee if the check bounces and sometimes it’s hard to collect the penalty from your tenants.

Advantages of Accepting Rent through ACH

Here are some of the advantages of accepting your rent through Automated Clearing House (ACH):

- ACH rent payments are usually credited to your bank account faster.

- Fewer (human) errors are made with ACH rent payments because the rental payments are directly deposited into your bank account and are fully automated.

Of course, there are other options to collect rent. We wrote an article that covers the best way to collect rent as a landlord.

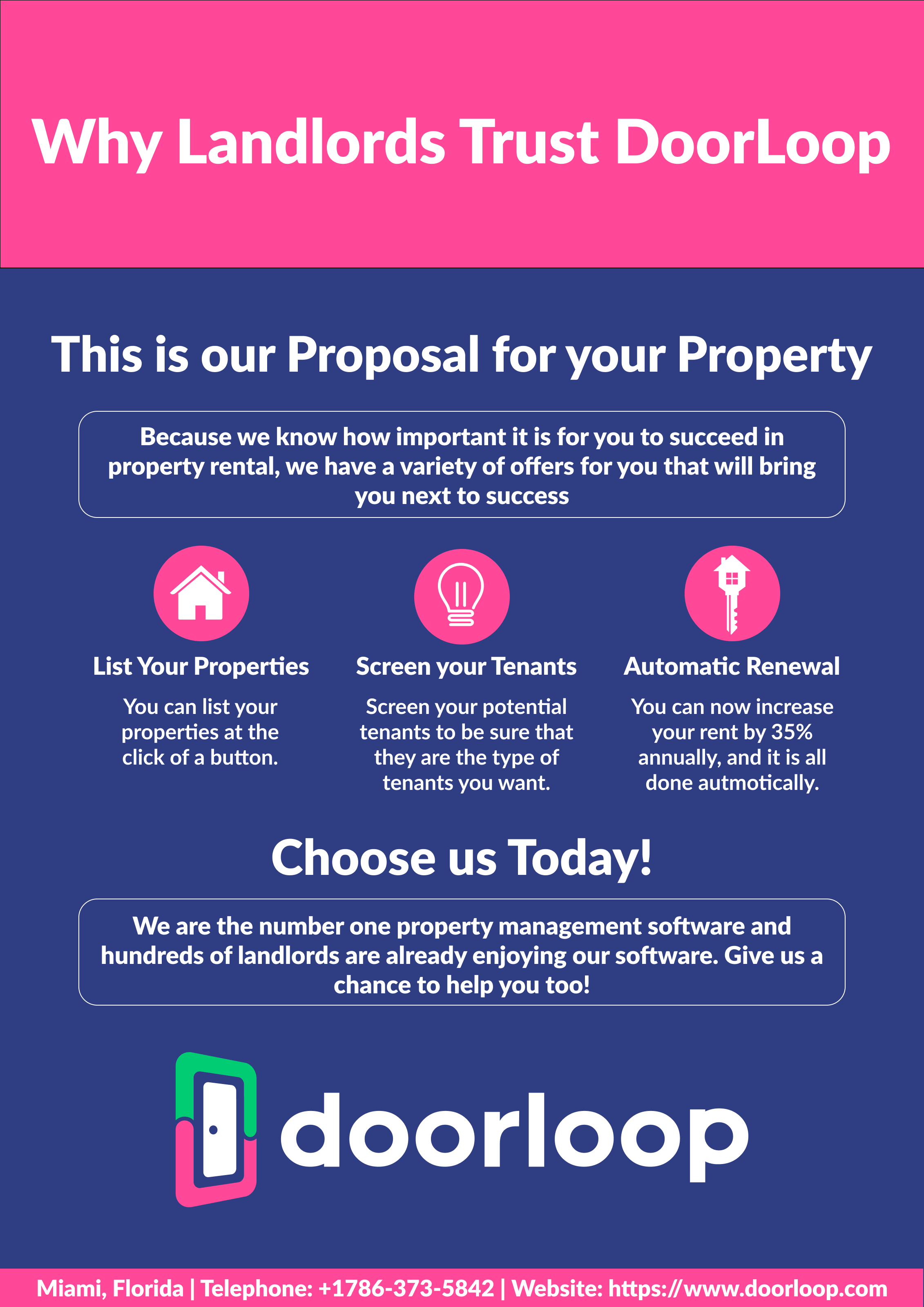

We're biased, but we think you should use DoorLoop to collect rent from your tenants.

RapidRent

In our experience, we have found that the more payment options you offer your tenants, the more likely they are to pay on time, and in full.

Tenants like the convenience of paying with their preferred means, whether that be credit card, debit card, check, cash, or ACH.

DoorLoop makes it easy to accept rental payments online by using RapidRent to automate the entire process.

.svg)